The Hawaii Probate Clock: Why Waiting Is the Costliest Mistake for Your Ohana

In Hawaii, we live by "Island Time"—a relaxed pace that makes our home special. But when it comes to settling an estate after a loved one passes, "Island Time" can become a legal and financial nightmare.

If you own a home or have over $100,000 in assets, your estate is likely headed for probate. In Hawaii, this court-supervised process is notorious for being slow, public, and expensive. While your family is grieving, the "Probate Clock" begins to tick, often locking away assets for 12 to 18 months—or longer.

What is the Hawaii Probate Clock?

Probate is the legal process of proving a will, paying off creditors, and eventually distributing assets to heirs. Because Hawaii has a unique legal landscape—including specific requirements for real estate and a lower state estate tax threshold than the federal level—the process is rarely "quick."

Without a Revocable Living Trust, your family must wait for the court’s permission to:

Sell a family home to cover expenses.

Access bank accounts to pay for funeral costs or mortgages.

Distribute sentimental heirlooms to the next generation.

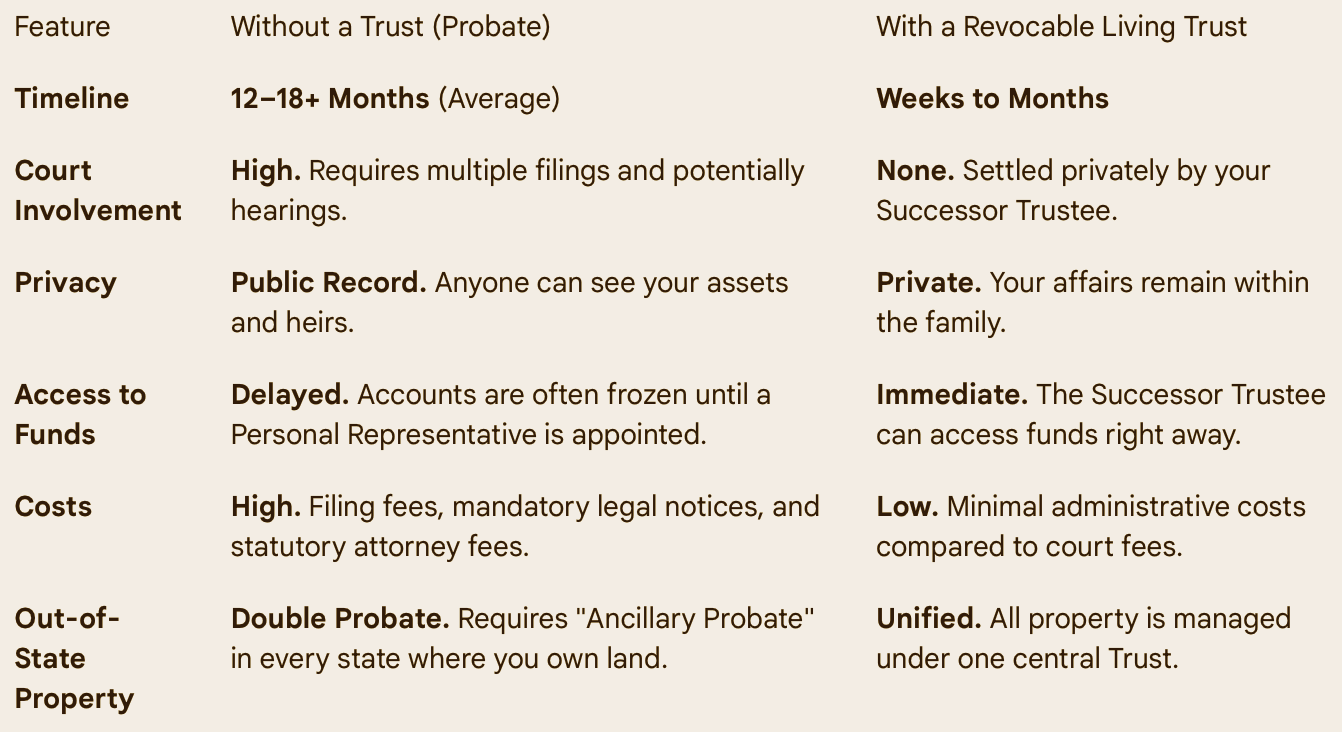

Comparison: With a Trust vs. Without a Trust

The following table illustrates the difference between a traditional probate path and a streamlined Trust administration in Hawaii:

^as you can see, a revocable living trust can help you avoid the expense of probate… one of our clients shared the fact that she estate spent $10,000+ on lawyers and 1.5 years for the court process alone.

Why Hawaii Real Estate Complicates the Clock

In the islands, real estate is often a family’s most valuable asset. If a home is owned solely in the decedent's name, it cannot be sold or transferred until the court appoints a Personal Representative. During this time, the "Probate Clock" keeps ticking while property taxes, insurance, and maintenance costs pile up.

If your heirs live on the mainland, this process becomes even more grueling, as they may have to fly back for hearings or deal with local vendors from thousands of miles away.

Stop the Clock Before It Starts

The good news is that the "Probate Clock" is optional. By establishing a Revocable Living Trust, you effectively remove your assets from the court’s jurisdiction. You maintain full control while you are alive, and you provide a seamless "handoff" for your family when you pass.

Don't leave your legacy to the speed and expenses of the court system.